北大金融数学系 20周年系庆系列报告 A-8 —Analysis of Markov Chain Approximation for Option Pricing and Hedging

主 题: 北大金融数学系 20周年系庆系列报告 A-8 —Analysis of Markov Chain Approximation for Option Pricing and Hedging

报告人: 李凌飞 助理教授 (香港中文大学系统工程与工程管理学院)

时 间: 2017-05-11 14:00-15:00

地 点: 理科1号楼1493

Abstract: Continuous time Markov chain (CTMC) approximation is becoming increasingly popular in option pricing under Markovian price models as a general valuation tool. Several practically important issues are not well addressed for this method including sharp estimates of convergence rates and how to compute delta and gamma. We obtain sharp convergence rates for European and barrier option prices in general diffusion models using the spectral method. We also propose a simple but effective method for computing delta and gamma and show that delta and gamma converge at the same rate as the option price. The applicability of our results to models with jumps are discussed through numerical examples.

报告人简介:李凌飞,香港中文大学系统工程与工程管理学院助理教授。

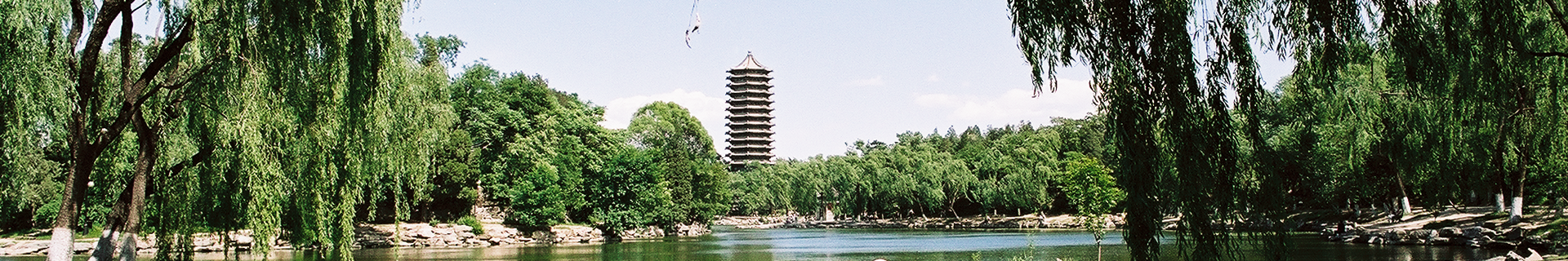

2003年进入304am永利集团,2005-2007年金融数学系本科学习,后在美国西北大学工业工程与管理系获得硕士和博士学位。2012年6月开始在香港中文大学任教,研究兴趣为金融工程,数理金融,计算金融。曾在金融数学,运筹管理以及科学计算顶级期刊Mathematical Finance, Finance and Stochastics, Operations Research和SIAM Journal on Scientific Computing发表多篇学术论文。现主持两项由香港研资局资助的基金项目。

主办方:304am永利集团金融数学系