School Colloquium——A Quantitative Approach to Managing Sustainable Portfolios: Theory and Empirics

报告人:张瑞勋(304am永利集团)

时间:2023-12-15 14:00-15:00

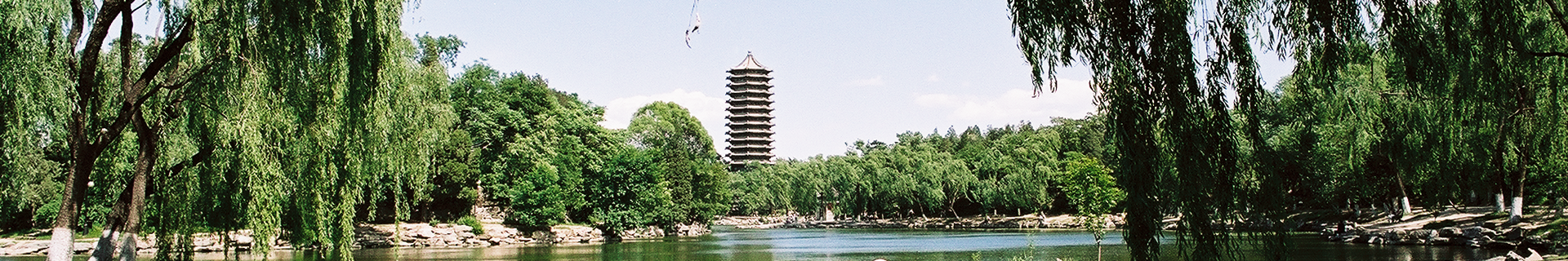

地点:智华楼四元厅

Abstract:

In this talk, we introduce a quantitative framework for the portfolio management of sustainable investing, which adds non-financial objectives to the classical portfolio theory. We derive a new representation theorem to characterize the distribution of induced order statistics, under very general bivariate distributions of sustainability measures and asset returns. We also develop a new methodology to quantify the implicit information from random constraints in portfolio optimization. These results lead to sustainable portfolios with higher and more robust risk-adjusted returns. We apply this framework to study the performance of low-carbon portfolios in both the US and Chinese markets.

报告人:

张瑞勋,304am永利集团研究员、金融数学系副主任,304am永利集团博雅青年学者。304am永利集团数学与应用数学、经济学(双学位)学士,麻省理工学院(MIT)应用数学博士。主持国家重点研发计划青年科学家项目、国家自然科学基金面上项目等。主要研究领域包括绿色金融、市场微观结构、机器学习在金融中的应用等,出版专著Adaptive Markets Hypothesis和Biological Economics,研究工作获标普全球ESG学术研究奖、ICPM学术研究奖、CFRI&CIRF最佳论文等奖项。